There are many approaches when it comes to repairability—what factors to consider, how much each one should weigh in a scoring system, and how to incorporate a wide range of devices. Every system is designed with different focuses and factors, and every system has flaws and foibles. It is important to understand what a scoring system is based on and how it works in order to interpret the value it provides. Here, we compare the iFixit Repairability Score with the French Repairability Index to shed light on their commonalities and differences, and reflect on what each scoring method signifies and its potential best use. We’ll take a look at the goals, scope, criteria, and methodology for each of the systems.

Similar Goal

iFixit’s Repairability Score and the French Repairability Index have similar goals. iFixit’s Score has two main goals: to inform consumers on the likelihood of a successful DIY repair, and to help manufacturers make more repairable products. Similarly, the French Repairability Index aims to inform consumer decision-making at the point of sale. The French Index focuses on how easy it is to repair, or get help repairing, electronic equipment. Both methods use a number that ranges from 0 to 10—10 being the highest/best score which indicates an easy repair process.

Different Scope

To assess the repairability of a product, both the iFixit and French Repairability Index (FRI) consider a repair ecosystem—the network factors that make up what you need to successfully complete a repair, such as parts availability, tools, and process. Both methods consider the design of the product to be repaired, the availability of spare parts, and the availability of repair information in the score. However, each method considers different elements within that ecosystem: different product parts, different repair agents (who is performing the repair), and a different product timeline. As a result, each method uses different criteria to assess product repairability.

iFixit considers a product’s “priority parts” to assess its overall repairability. These are parts with a high likelihood of failure and/or high functional relevance to the product. The list of priority parts is specified and defined for a product category (such as smartphones or laptops). On the other hand, the French Repairability Index considers a number of predefined parts, which are categorized into two lists: “List 2: Broken and Malfunctioning Parts,” and “List 1: Functional Parts.” These part lists are similar, but not identical. For example, in the case of laptops, iFixit assesses the repairability criteria on seven priority parts, namely the battery, storage drive, cooling fan, memory, display assembly, keyboard, and I/O ports. The French Index considers those assessed by iFixit plus the power connector in the laptop, the charger, and the motherboard.

The scores also differ in the repair agents they consider. iFixit’s method considers consumers—more specifically, iFixit looks at the repair ecosystem available for self-repairers, on the assumption that DIY repair enables all levels of repair (authorized technicians, in-house technicians, etc.) In contrast, the French Repairability Index considers consumers and, for certain criteria, also considers professional repairers, spare part retailers, and the manufacturer’s in-house repair services.

Another significant difference in scope is the timeline each method considers. iFixit bases the score on publically available data available at the time of the analysis, whereas the French Index considers the data available at the time of analysis and the manufacturer’s (self-attested) commitment to making that data available over time, i.e., the duration of availability of spare parts or repair information over a number of years.

Similar Methods, Different Criteria and Weights

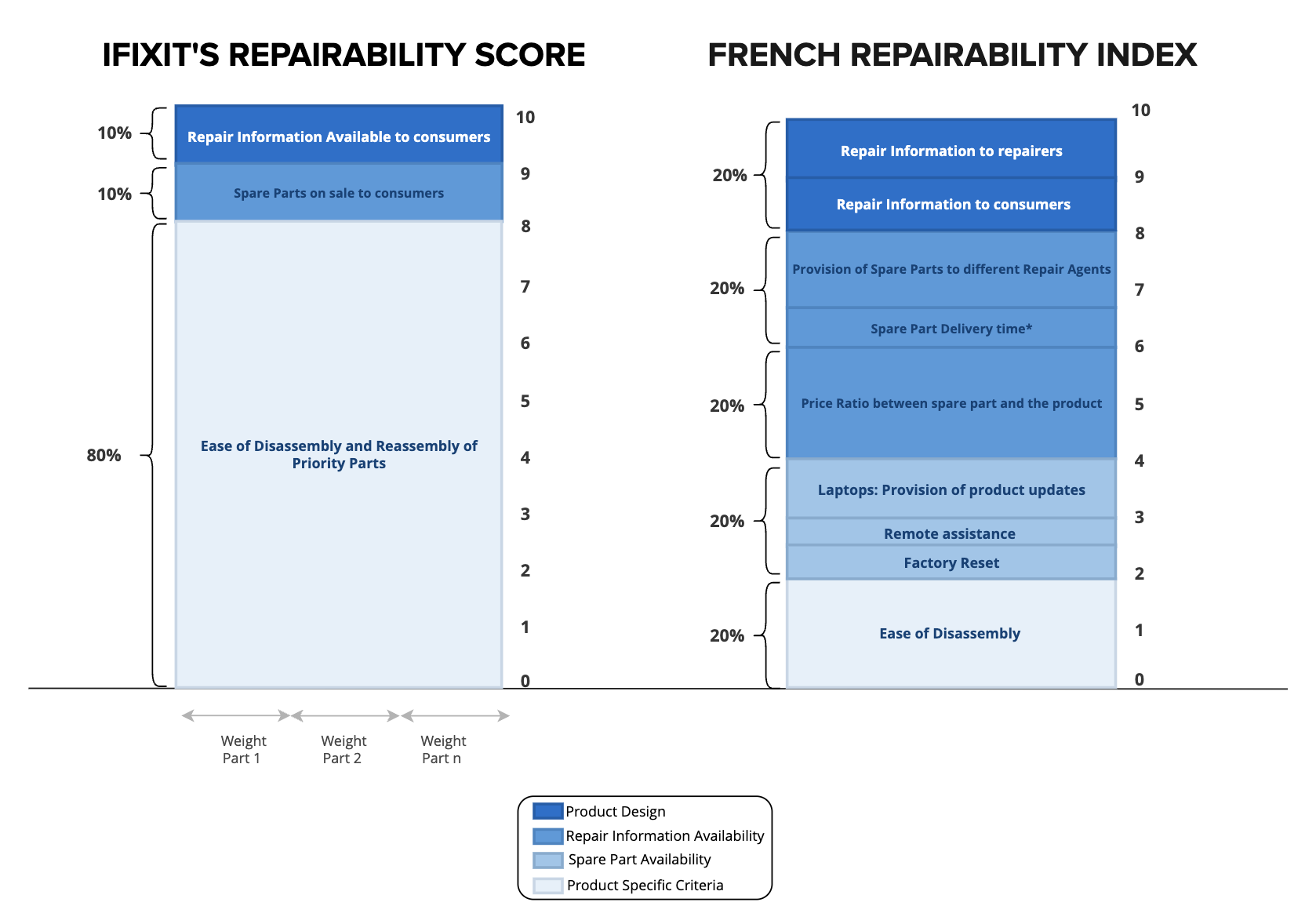

iFixit’s method and the French Repairability Index follow somewhat similar approaches to score a product. A set of criteria is developed to assess the repairability of the product (e.g., ease of disassembly, spare part availability, etc). These criteria are evaluated and a final score is calculated as the sum of the scores of all criteria. While similar, there are some key differences. Moreover, each method assigns different importance (weight) to each criterion. Figure 1 depicts these differences. The methods also differ on how the various criteria are measured.

Before we delve into the calculation details, it is important to keep in mind that iFixit’s score has three main criteria: ease of disassembly and reassembly, which accounts for 80% of the score, availability of spare parts (10% of the score), and the provision of repair information (10%). Whereas the FRI considers ease of disassembly (20%), availability of spare parts (20%), ratio of price of spare parts (20%), provision of repair information (20%), and product specific criteria (20%).

To measure the ease of disassembly and reassembly of the priority parts, iFixit uses proxy times. Each disassembly and reassembly action has a proxy time assigned. These times are augmented using correction factors to account for tool changes and different tool types. Essentially, this means complicated or proprietary tools get a penalty. Consequently, the ease of disassembly and reassembly of a priority part, i.e., the final proxy time assigned to each priority part, is the result of multiplying each action’s proxy time by the associated tools’ correction factors, and then summing the results. The final proxy time for each part is then translated into a weighted score using a range of times specifically developed for each product category.

The French Repairability Index assesses a product’s design based on the ease of disassembly only and uses different means of measurement. It defines three subcriteria for the assessment: the disassembly depth of the parts from “List 2” (i.e., the number of steps needed to reach the parts from “List 2”), the type of tools needed to access them, and the fasteners used to assemble the components from “List 2” and “List 1.” Different types of tools and fasteners have been categorized and translated into scores. The highest scores are assigned to a low number of steps, the need for only basic tools or no tools, and the use of removable and reusable fasteners, such as screws.

To assess the availability of spare parts, iFixit determines if priority parts are sold on manufacturer’s website (or that a link to purchase them is provided) at the time of the analysis. The highest score is assigned when all priority parts are on sale to the public at the time of analysis. The lowest score, a zero, is assigned when none are available.

In contrast, the French Index assesses whether spare parts for components from “List 1 and List 2” are on sale at the time of analysis and their delivery time within France. These subcriteria are assessed separately for four repair agents: consumers, professional repairers, spare part retailers, and the manufacturer’s own repair services. Scores are assigned based on the number of years manufacturers say they will provide spare parts and the number of working days between ordering the part and its arrival. The highest scores are awarded to a parts that the manufacturer says will be available for a long duration (7+ years) and short delivery time (between 1 and 3 working days).

In addition to spare part availability, the French Repairability Index assigns another 20% of the score to spare part pricing. Here, the score is determined by calculating the average between the pre-tax price of the most expensive spare part from “List 2” and the average pre-tax price of the rest of the spare parts from “List 2.” This quantity is then divided by the pre-tax price of the product. The French Repairability Index assigns the highest score when this ratio is 0.1 or less and establishes that all spare parts must be available for purchase as a requirement for scoring, otherwise this criteria receives a zero.

To assess the provision of repair information, iFixit determines whether repair information is free and publicly available on the product manufacturer’s website and whether it is relevant for the repair of the priority parts—that it contains repair instructions for all the priority parts, an exploded view of the product, a list of parts and tools, and board diagrams. The highest score is assigned when all information is complete, free, and accessible; and the lowest when none is available.

The French Index also assesses the provision of repair information, although it does not look at priority parts or listed components but rather assesses the repair information in general. This set of criteria distinguishes between the information available to repairers and that available to consumers. Some of the content that the French Index assesses is the provision of wiring and connection diagrams, diagnostic and error codes, the availability of instructions for software and firmware reset, and how to access professional repairers. The duration of the provision of the information (in a number of years) has also been ranged and related to a score. The highest score is assigned when the information will be available for at least 7 years after the last product sale.

Finally, the remaining 20% of the French Repairability Index accounts for product-specific criteria related to the provision of product updates, remote assistance for repairers and consumers, software and firmware reset, and access to usage counters.

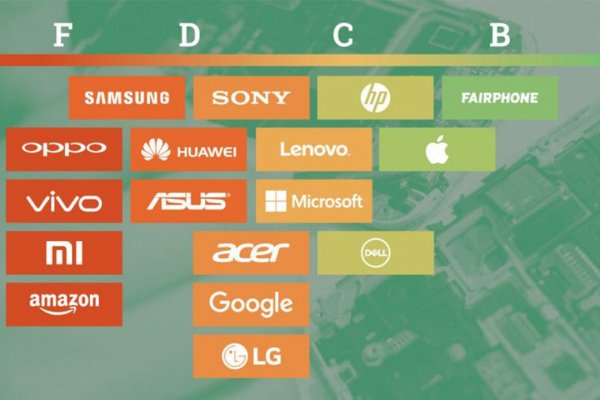

Same Range, Different Meaning

iFixit’s method and the French Index have several aspects in common. They both stem from the EN45554 standard; they both aim to inform on the repairability of electronic devices; they both consider a product’s design, the availability of spare parts, and information as key aspects in assessing the repairability of a device; and they both present the results in a final aggregated score that ranges from 0 to 10, where 10 is the highest score and signifies the easiest repair. However, besides those commonalities, iFixit’s Repairability Score and the French Repairability Index differ in their scope, their criteria, the importance they assign to criteria, product parts (weights), and how they measure the criteria. Therefore, the scoring results are not comparable between methods and serve different purposes.

iFixit’s scoring method, with its greater emphasis on product design, benefits from evaluating ease of both disassembly and reassembly of the product, which may provide a more complete assessment of hands-on aspects of the repair. But its overall scope is somewhat narrower, and it only evaluates publicly available repair resources, since manufacturers are not required to supply any information to iFixit. The French Index leverages direct reporting from manufacturers to provide a more complete picture of the overall repair ecosystem within France and for a greater range of repair agents. However, since the scores from manufacturers are self-attested, their accuracy cannot always be verified. Additionally, because of the broad range of criteria scored and the straightforward way in which the French Index aggregates them, it’s possible for a product to fail one or more criteria—thereby making repair impractical—but still achieve a very high “repairability” score because poor scores in one criterion are compensated by others. On the flip side, there are some heavy penalties for not having parts all available, which causes the entire “parts pricing” criteria to score a zero, even if the majority of the parts exist and are affordable.

The pros and cons of each method could be debated indefinitely, but ultimately, both are useful tools for learning about how repairable a device is. Like all complex systems, there is no perfect way to capture all the elements of repair perfectly in one system. These systems continue to evolve—stay tuned for updates—and refine how they address repair topics and distill that information for public consumer awareness. We consider it an ongoing mission to continue educating consumers around repairability and to provide tools and as much information as we can. As our knowledge and experience grows, we will continue to share what we learn to help you make more repairable choices and fix the world.

0 Comments